The rates cap and your rates

Each year the Victorian Government sets a rate ‘cap’. In 2023/24 the cap is set at 3.5 per cent.

We recognise that our community is facing cost-of-living pressures. That's why we decided to increase rates by 2.8 per cent. Lower than the rates cap and well under the expected 4.5 per cent inflation rate.

Will my rates go up by the rate cap?

No, the rate cap does not apply to individual rates notices. It means that the general rates revenue raised by Council will not increase by more than the cap.

This does not mean that your rates bill will increase by the same amount.

Your rates bill may go up or down depending on several things, including the change in the value of your property and the type of property you own.

Will Council get more money if property values go up?

No.

All properties are revalued on 1 January each year. But Council do not receive extra money when property values rise.

Some ratepayers' rates will rise by less than the rate cap and others will pay more. But the overall general rates we collect won't exceed the rate cap. This year the overall rate revenue increase is lower than the rate cap set by the Victorian Government.

Rate capping explained

The Municipal Association of Victoria's video helps to explain how rate capping works.

Find out how rate capping affects us - Port Phillip rate capping fact sheet (PDF 161 KB). For more information go to Essential Services Commission.

How are rates set?

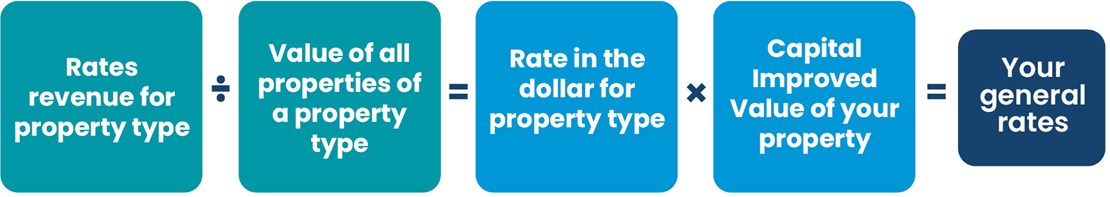

In Victoria, all councils set rates by figuring out the total rate revenue to be collected, and dividing that amount by the total value of all properties. That amount is the rate in the dollar.

In the City of Port Phillip, we have a differential rate scheme. This means the rate in the dollar is different for 3 categories of property:

- residential

- commercial/retail

- industrial

For each category, we figure out the total rate revenue to be collected and divide it by the total value of all properties in the municipality. That amount is the rate in the dollar for all properties of that type.

The total rate revenue cannot exceed the rate cap. This means we do not receive more money when property values rise.

The rate in the dollar is then multiplied by the market value of each property. Every property is valued every year.

The total amount you pay will also include the waste charge of $198.20 and the Victorian Government's fire services property levy.

Calculating rates

What do my rates pay for?

We use rates revenue to fund community services including waste and recycling, graffiti management, childcare, health services, libraries, aged care, environmental sustainability, heritage protection, festivals and events, planning and building regulation, and support for business and the arts.

It is also used to pay for maintenance of community infrastructure including parks, playgrounds, sports fields, foreshore and beaches, roads, footpaths, cycleways, public lighting, drains, public toilets, and community facilities.

Find out more about rates in 2023/24 and what they fund – read our rates brochure (PDF 824KB).

Contact the rates team

To talk to us about your rates send a direct message or phone us on 03 9209 6777 during business hours Monday to Friday.